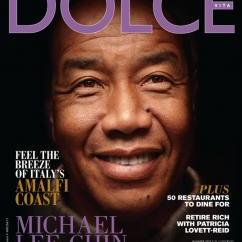

Michael Lee-Chin was born in Port Antonio Jamaica in 1951 of bi-racial (Chinese and Black) parents. He lives between his homes in Hamilton, Ontario, Canada and Miami Florida. Lee-Chin is a business magnate, investor, and philanthropist and the founder and Chairman of Portland Holdings Inc., a privately held investment company which owns a collection of diversified operating companies in sectors that include media, tourism, health care telecommunications and financial services.

He is currently Executive Chairman of AIC Limited (a Canadian mutual fund), and the National Commercial Bank of Jamaica. He is named in the latest Forbes Billionaires List at number 701, with assets worth around $1.0 billion, though Lee-Chin's wealth has been as high as $2.5 billion in the past. He has also been named by Canadian Business as one of the richest people in Canada.

Lee-Chin made headlines in 2003 when he donated $30 million to the Royal Ontario Museum (ROM). He also provided a $10 million gift to the Rotman School of Management at the University of Toronto which established the Michael Lee-Chin Family Institute for Corporate Citizenship. The Lee-Chin Institute's purpose is to help current and future business leaders integrate corporate citizenship into business strategy and practices.

Lee-Chin’s first job was in 1965 as part of the landscaping team at the Frenchman's Cove Hotel and in 1966 he got a summer job working on the Jamaica Queen cruise ship, cleaning the engine room.

In 1970 he went to Canada on a scholarship program sponsored by the Jamaican Government to study Civil Engineering at McMaster University, and graduated in 1974.

In 1974, he married Vera Lee-Chin, a Ukrainian Canadian that he had met at University and returned to Jamaica to work briefly as a road engineer for the Jamaican Government.

Lee-Chin then returned to Canada after having difficulties finding work in his qualified field. He initially worked as a bouncer, but later found employment as a financial advisor for an investment group.

After two years in their Hamilton, Ontario office, Lee-Chin moved to Regal Capital Planners and in 1979 became regional manager. In 1983, he secured a loan from the Continental Bank of Canada for C$500,000 to purchase a stake in Mackenzie Financial Group and formed Kicks Athletics with Andrew Gayle; by 1987 the investment was worth C$3.5 million.

In 1987, Lee-Chin took the proceeds from his Mackenzie investment and bought Advantage Investment Council (a Kitchener-based company) for $200,000 but with holdings of around C$800,000. He renamed the company AIC, and developed it to a fund that today controls around C$6 Billion, with hundreds of thousands of investors.

Following the acquisition of AIC Limited, Lee-Chin set up the Berkshire group of companies – comprising an investment planning arm, a securities dealership and an insurance operation. By 2007, Berkshire amassed more than C$12 billion of assets under administration. In 2007, Manulife acquired Berkshire from Portland Holdings in exchange for shares, making Portland one of the largest shareholders of Manulife.

In 2009, Lee-Chin sold AIC Limited to Manulife for an undisclosed amount. With the acquisition, Manulife Securities would manage some $13 + billion in mutual fund assets in Canada.

In the late 1990s and early 2000s Lee-Chin saw potential in his native country, and Portland purchased 75 per cent of the National Commercial Bank of Jamaica for 6 billion Jamaican dollars (US$127 million) from the Jamaican Government.

In 2003, Senvia Money Services Inc., a global money transfer company was established. This was followed in 2004, by the acquisition of AIC Financial Group Limited, headquartered in Trinidad.

In 2004, he announced plans to set up the AIC Caribbean Fund with the intention of investing in the entire Caribbean region. The stated aim of the fund is to raise US$1 billion in order to "make investments in businesses located in countries of the Caribbean Community (CARICOM), with an emphasis on Jamaica, Barbados and Trinidad and Tobago". So far, it has made a number of large-scale investments.

In 2006, Portland acquired an 85 per cent controlling stake in the United General Insurance Company, the largest auto insurer in Jamaica, and renamed the firm Advantage General Insurance Company. A controlling interest in CVM Communications Group (consisting of radio and television stations and newspapers) was purchased at the same time.

Portland partnered with the Canadian Risley Group to form Columbus Communications Ltd. – a Barbadian corporation that holds controlling interest in a number of telecommunications providers in the Caribbean including Cable Bahamas Ltd. Caribbean Crossings Ltd., Merit Communications Ltd, and FibralLink Jamaica Ltd.

In the tourism sector, Michael guided Portland through a number of acquisitions in the Caribbean. Among them are, the hospitality operations of the Trident Villas and Spa in Jamaica, Reggae Beach and Blue Lagoon. Portland first acquisition in the health care industry sector was announced in July 2006, when Medical Associates Ltd., a privately held hospital in Kingston, Jamaica, joined the Portland Group.

Lee-Chin separated from his wife Vera Lee-Chin in 1991 after having three children (Michael Jr., Paul, and Adrian). Lee-Chin now lives with Sonya Hamilton, with whom he has fraternal-twin daughters, Elizabeth and Maria in Flamborough, near Hamilton, Ontario, and Miami Beach, Florida.

Currently Lee-Chin is eyeing other prospective investment opportunities and his house in the Miami Beach area is up for sale at a price of US$37M.

- Login to post comments

Recent comments

9 years 11 weeks ago

9 years 31 weeks ago

9 years 35 weeks ago

9 years 38 weeks ago

9 years 39 weeks ago

12 years 6 weeks ago

12 years 20 weeks ago

12 years 40 weeks ago